TAX COMPLIANCE FOR SMALL BUSINESS

Many businesses find themselves on the wrong side of the law due to non-compliance with tax laws

. To some, this may happen not because they do not want to pay taxes, but because they do not have proper measures to know what they are supposed to pay. Such cases may leave a business with less money when time comes to remit tax. Are you facing a similar tax compliance situation? How do you ensure your business is tax compliant? Below are some tips.

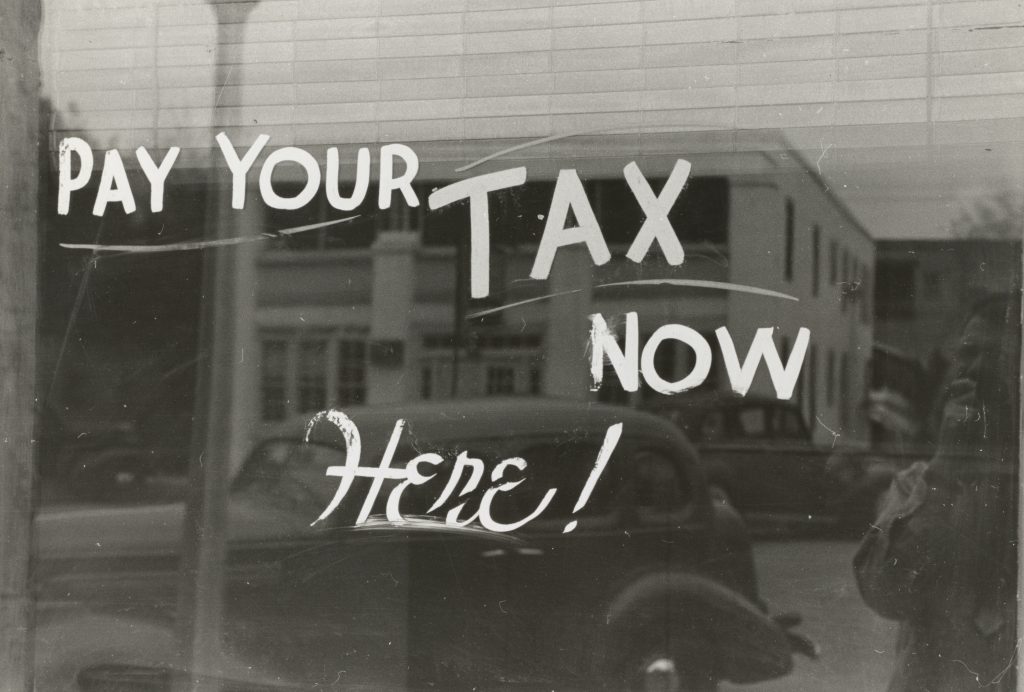

Photo by The New York Public Library on Unsplash

MAINTAIN PROPER FINANCIAL RECORDS

A good number of those who fail to pay taxes are unable to determine the amount they are supposed to pay. This can only be possible due to failure to keep proper financial records. To avoid this you need to ensure all transactions made by your business are recorded. This should be right from the day you start doing business and should reflect all transactions- whether involving large or small amounts of money.

For better bookkeeping, it is advisable that you employ the services of professional accountants. There are many different types of accountants that specialize in different trades. If your business deals with construction hiring, construction accountants will be suitable for you. These are accountants who specialize in offering services to property developers.

DON’T LEAVE OUT ANY EXPENSES

There are lots of expenses associated with running a business. However, most business expenses go unnoticed at the end of the day as they are not included in the books of accounts. Most of these are small expenses that do not seem much but will be a significant value when accumulated for some time.

To avoid this and help with tax compliance, ensure that all expenses incurred are recorded. This includes small expenses like mail charges. Getting a receipt for all transactions will help in achieving this. If possible, consider using digital payment options as they would be easy to trace.

Some business expenses may be confused with personal expenses and fail to be recorded. If you have any doubts, consult with a professional accountant.

PLAN YOUR TAX BUDGET

You may do all the above and know the amount of tax you should pay. However, you may find yourself with less money when time comes to remit tax. You should understand that you’re not entitled to all the profits made by your business. As such, you take your share and save the rest for taxes. A good figure would be about 30% of your profits saved for the purpose of paying tax.

In line with this, it would do you good to attend tax compliance workshops regularly. This will keep you updated with all matters concerning tax.

CONCLUSION

Tax compliance should be one of the top priorities for your business. It will mean that your business will not be faced with any legal issues due to failure to remit taxes. This article has shared with you tips on how to ensure your business complies with the relevant tax laws.