Deductions that Help Startups Save Money

For a startup, being creative with your business decisions can save you and your employees much needed cash. A key area of savings is to look into tax deductions. Some people are required to wear a tie and a suit to work, while others are required to wear branded uniforms or to advertise the clothes from a shop that the person works in. Regardless of what type of clothing you have to wear, you will first need to establish the dress-code policy for your startup, in order to determine how and if you can claim for clothes when it comes to your next tax period.

To assist you in making the most from deductions on work-related clothing, here is a guide that outlines what you can’t and what you can claim.

What Expenses For Work-Related Clothing Can You Claim?

In regard to what you are wearing to work every day, there are a few clothes-related deductions that you are able to claim in association to cleaning and buying occupation-specific clothing like:

- Unique and protective clothing that does not include every day wear

- Clothing which identifies your occupation easily, such as checked chef-trousers

- Distinctive uniforms

- Footwear and clothing that you are required to wear in order to keep you safe and protected from risks associated with injuries or illnesses associated with the environment that you conduct your job in. For the clothing to be thought of as protective, these items have to offer enough protection against the associated risks, which can include:

- Sun-protection and fire-resistant clothing that includes sunglasses

- Rubber boots for construction industries

- Hi-vis vests

- Nurse shoes that are non-slip

- Heavy-duty trousers and shirts, overalls, gloves and steel-capped boots

- Aprons, smocks and overalls that you wear to prevent soiling or damages to your normal clothes, while you are on the job

Clothing Deductions For Nurses

If you have health care providers as employees, you can claim for deductions for costs related to clothing that is specific with your work in the role of a nurse. Specific nurse deductions that you are able to claim include:

- Memberships and registration fees

- Non-slip shoes, laundry and uniforms

- Self-education and conferences

- Tools that you use in your trade such as nursing fobs, reference books, stethoscopes along with other type of medical equipment

- Pagers or mobiles, when you are on call

You are also able to claim for the costs to renew your practicing certificate annually, along with attending training courses, conferences and seminars that relate to your work. Additional costs you can claim for include magazines, periodicals and journals that contain content that is nurse-specific.

If your uniform is compulsory, you could also claim for socks, stockings, non-slip shoes or for the single items such as a tie, if they form a part of the working gear. There are also garments that are occupation-specific that are not every day in their nature but still allow others to recognize that you are a nurse. You can claim for the costs to dry-clean or launder these eligible working clothes like your uniform that is required.

More information on tax returns dedicated to nurses.

Clothing Deductions For Drivers

If you are a driver, you are not able to claim for the costs of clothes that are conventional or ordinary, even when you have specifically purchased these clothes for work. You can, however, claim costs for enforced compulsory uniforms that identify you in the role of an employee for an organization which includes jumpers, jackets, skirts, pants, and shirts.

The specific expenses for drivers that can be offset from your overall tax will include:

- Fridges

- CB radios

- Sleeping bags

- Working dogs, which includes a depreciation deduction when it comes to livestock carriers along with immediate deductions for any maintenance costs

- Tools required for truck repairs

- Sun protection clothing and sunglasses that can include sun-protection shirts, hats, and sunscreen

- The protective equipment that your employer did not supply, that can include: winter jackets, high-vis vests, steel-capped boots, goggles, gloves and masks

- Briefcase or work bag, log books, diary and stationery

More information about driver’s tax returns.

What Type Of Clothing Deductions Are Not Claimable?

When it comes to office workers, there is not much that you are able to claim. You cannot claim costs for cleaning or purchasing the work clothes which are not specific to the occupation. This may include business suits, white shirts or bartender’s black trousers. If your occupation is in clothing-retail you are not allowed to claim on the clothing that you purchased from the store, even when you are forced to wear these items to work. The reason behind this is that these items of clothing are not specific to the occupation as you can also wear these items outside of work.

The regular items like trousers, closed shoes, shorts, skirts, shirts and jeans are not regarded as protective clothing when they are lacking protective qualities that are designed for risks associated with your work. An example of this may be closed shoes, that you say to provide your feet with protection from any workplace hazards. Unless this protection extends over-and-above the standard foot protection level, you will not be allowed to claim for a deduction.

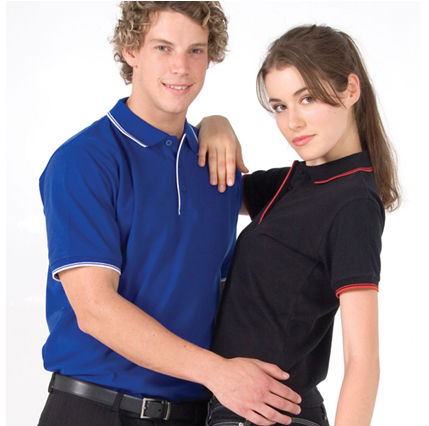

Claiming For The Costs Of Work Uniforms

Compulsory Work Uniforms

Uniforms are designed to identify employees in an organization. The uniform has to be enforced to wear when you are at work with an enforced policy that ensures this enforcement. If this happens to be the case that surrounds your uniform, then cost will be deductible.

When your stockings, socks and shoes also form a part of the compulsory and distinctive uniform, then you can also claim for deductions. Their type, style, and color have to be specified in the uniform policy from your employer, which is often the case with nurses and air stewardesses. It may also be possible for claiming on single items of distinctive clothes like a jumper when it is compulsory at work.

Non-Compulsory Work Uniforms

In certain cases, you may be able to claim for the non-compulsory uniforms, as long as it is distinctive and unique to the organization that you work for. In order for clothing to be regarded as unique, it must be made and designed solely for an employer. These clothing items must feature the logo of the employer attached permanently and cannot be made available for purchases from the public.

You are not able to claim for the costs involved in either the purchase or the cleaning of a logo-free, plain uniform like generic black trousers and white shirts that wait staff wear. The work uniforms that are non-compulsory will in most cases need to have their design registered with the AusIndustry for it to be a tax-deductible consideration. Stockings, socks and shoes are not considered to form a part of non-compulsory uniforms or the single items like a jumper.

Dry Cleaning Work Clothing

You can claim for the costs related to washing, drying, dry-cleaning or ironing work clothes that are eligible. Written evidence associated with laundry expenses such as receipts or in diary entries must be maintained when the claim amount exceeds $150 and the total claim associated with work-related expenses has exceeded $300. This will not include meal allowance, car, travel-allowance expenses and award-transport payments.

If you are interested in claiming for your uniform then check out this form from Tax Turned.

Learn more on the work-related expenses your startup may be able to claim for.