Whether you are a startup or a startup investor, taxes impact you, and tax season is upon us. And that means everyone is frantically searching for receipts, invoices, W-2s, 1099s, 8938s, bank account information, et al. It’s a dizzying time for businesses. Amid all the hype is clarity: How much profit or loss did your business generate during the financial year? Tax season is a time for reflection. Business owners get to examine their company’s strengths and weaknesses, and channelling resources accordingly. At the end of the day, you may be left with a profit, either through a tax refund, or cash in hand that you do not wish to reinvest in the organization. Fortunately, there are many viable investment opportunities available to you in your personal capacity. That includes alternative investments that hedge against economic changes.

Reviewing Your Investment Options

How is the market performing?

Market performance can change on a dime. However, the fundamentals of the economy are structurally sound. This means that barring a geopolitical shock and acts of God, the bedrock of the US financial system is solid. Given this reality, it is a lot easier to pick asset classes that are tailored to your risk preference. Business owners are by their very nature risk seeking individuals. The entrepreneurial flair that gets a business up and running requires as much. That does not mean that business owners avoid playing it safe – on the contrary, they make sound decisions based on analysis, research and intuition.

The current performance of the financial markets is evident by exploring the performance of its individual components, and then generating a holistic picture of the economy.

Expert Commentary

As a prelude to tax season reviews, Olsson Capital finance guru, Montgomery Lyons succinctly summed it up as follows:

“US bourses have enjoyed a dizzying year of gains. The Dow Jones is up 18.53%, the S&P 500 index is up 15.13%, and the NASDAQ composite index is up 26.79%. Despite short-term volatility, the long-term trend remains bullish. We can expect more of the same provided the fundamentals of the US economy remain structurally sound. Moving on to commodities, both Brent crude oil and WTI crude oil are trading in the mid-low $60 per barrel range. Oil prices have not reflected too much volatility in 2018, and this has helped to stabilize financial markets.

Precious metals like gold have also traded in a tight range over the past 52-week period. With a low of $1,218.50, and a high of $1,370.50 per ounce, the gold bugs will be somewhat pleased that this safe-haven asset has retained its shine. Whether gold can continue on its upward trajectory depends on the performance of equities markets. Any shock drops in equities such as what happened in mid-February 2018 could send gold prices sharply higher.

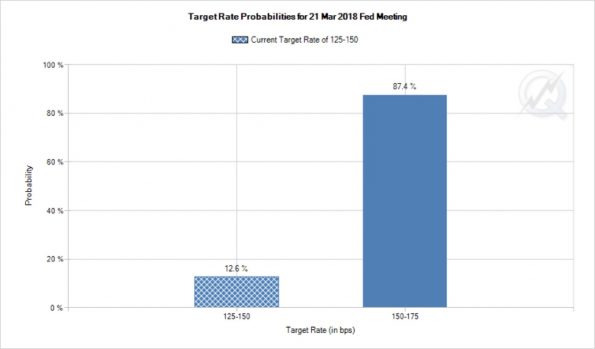

As we move to the macroeconomic variables, there is widespread agreement that the Fed will continue quantitative tightening initiatives in 2018. The latest news from the CME Group FedWatch indicators suggest that the probability of a 25-basis point rate hike on Wednesday, 21 March 2018 is now sitting at 87.4%. If the Fed acts, this will see the interest rate rising in the region of 1.50% – 1.75%.

A Fed rate hike is a big deal for the broader economy. It indicates that there is a degree of concern about inflationary pressures – owing to tax cuts and increased wages for workers. To counter rising prices (brought upon by too much money chasing too few goods and services), the Fed raises the federal funds rate (FFR) to keep the economy at full employment and 2% inflation. If prices rise too quickly, this could result in the economy overheating.”

A Nugget of advice that you can Bank on

There are key takeaways from the current state of the economy. When interest rates are rising, gold is not the best investment to make. Why? Because gold is not an interest-bearing asset like a fixed deposit. Additionally, when stock markets are red-hot, funds are being channelled into stock purchases and away from gold. Gold is similar to the Japanese Yen in that they are both safe-haven assets. Whenever there is uncertainty, traders flock to gold as a store of value. Steadily rising interest rates are somewhat alarming for the performance of major bourses.

When the cost of borrowed money increases sharply, this puts pressure on listed companies to repay those debts. Ultimately, it’s the consumers who bear the burden in the form of higher prices. While minimal interest rate hikes have a minimal effect, the sustained effect of rate hikes ultimately degrades the performance of indices. There are exceptions to this in the form of bank stocks. Banking and financial stocks prosper when interest rates are rising – since they are in the business of lending money!

During tax season, a re-evaluation of the overall economy, inflation, and market valuations is critical to charting a course for healthy investment returns.

Is this article helpful? Please provide comments and feedback.