Would you benefit from the VAT Flat Rate?

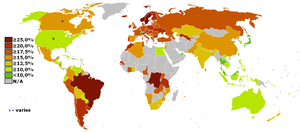

English: Tax rates around the world: VAT flat rate (Photo credit: Wikipedia)

Under the flat rate VAT scheme, you’d charge VAT to your customers (“output VAT”) in the normal way, and pay VAT to your suppliers when you buy goods or services from them (“input VAT”), again as normal.

But when it comes to preparing your VAT return and paying VAT to HM Revenue, instead of adding up all the VAT you charged and taking away from that the VAT you can reclaim, when you’re on the flat rate scheme, you use a different method.

You add up all your sales (including exempt sales), including any VAT you charged to your customers, and work out a percentage of those sales – and that’s the VAT you pay to HM Revenue.

But you don’t just include the sales you charge standard-rated VAT on. You need to include any reduced-rated, zero-rated and exempt sales you make as well – and you do also need to include interest you receive from the bank on a business account. HM Revenue give more information here.

And you can’t claim back any of the VAT you made on purchases – apart from if you buy a capital asset that cost £2,000 or more including VAT, and on the stock and assets you held when you registered for VAT.

Can anyone use the scheme?

Unfortunately not. You can’t just start using the scheme, as you have to apply to HM Revenue if you want to join.

To use the Flat Rate VAT, your total estimated VAT taxable sales – that is everything you plan to sell that is subject to VAT (including zero-rated sales but excluding exempt sales, sales outside the scope of VAT, and sales of capital assets), for the next year – must be under £150,000 excluding VAT.

But once you join the scheme you can keep using it until your total business income goes above £230,000 a year.

However, there are some businesses which can’t join the scheme.

If you’ve been in the scheme before and left it less than 12 months ago, you can’t rejoin. You need to wait until a year has gone by before you rejoin.

And HM Revenue won’t let you join the scheme if you’ve been guilty of a VAT offence or charged a penalty for evading VAT within the last 12 months.

Users of second-hand margin schemes can’t use the flat rate scheme. And if you are, or have been within the last 24 months, a member or potential member of a VAT group, or registered for VAT as a division of a larger business, you can’t join.

You also can’t join if your business is closely associated with another business.

Why would you want to join the scheme?

HM Revenue say it makes your record-keeping simpler because you don’t have to work out what VAT you can claim on your purchases – and, because there are a lot of potential pitfalls in this area, I would agree with them.

It can also save you money, though it’s not designed with this in mind. This tends to depend on what sector you’re in, and how much VAT you pay out on your costs.

If your main cost is your own labour, you could well save a fair amount of money by joining the flat rate VAT.

Let’s take an example.

Stephen is a freelance social worker. His flat rate percentage is 11%. Because his main cost is his own time, he has almost no input VAT to reclaim.

When Stephen invoices his clients, he adds 20% standard VAT as normal.

Stephen issues an invoice to his client for £1,000 + VAT, so £1,200 in total.

If he were not on the flat rate scheme, he would have to pay £200 to HM Revenue in output VAT.

Because he is on the scheme, he would instead pay £1,200 x 11% = £132 – saving him £68 just on that one invoice.

So if his sales for the quarter were £30,000 excluding VAT, he will save a total of £2,040 by being on the flat rate scheme.

When would it not help me to join the scheme?

Because your flat rate taxable sales includes exempt sales, it’s probably not a good idea to join the scheme if you make a lot of exempt sales – you’d pay more in VAT.

For example, a funeral director would be very ill-advised to join the flat rate scheme, because burial of the dead is exempt from VAT.

If you make a lot of zero-rated sales, and/or if you also buy in a lot of standard-rated goods and services, it’s also likely to cost you more in VAT if you join the scheme. In this situation, by not using the flat rate scheme you would usually get a repayment from HM Revenue each quarter, which you won’t want to lose!

Remember it’s worth crunching some numbers before you apply to join, because although the flat Rate Scheme could save you money it could also cost you money, depending on your business!

Related articles

- The risks and benefit of outsourcing manufacturing to China (thestartupmag.com)

- Responding to rapid growth (thestartupmag.com)

- Joseph Tartaglione, Founder & CEO OutBoostMedia talks to The Startup Magazine (thestartupmag.com)