No Time for Bookkeeping? 5 Tips for Busy Startups

Bookkeeping is a joy for some and a burden for others. Whichever side of the fence you fall on, streamlining your process and understanding the system is key to faster record keeping.

Here are five tips to make bookkeeping easier and save time that’s better used elsewhere in building your new business.

Keep Things Simple

In the excitement of a new business venture, it’s tempting to arm yourself with a big, fancy, expensive accounting software package that you don’t need. Often, not only do you not need it, it will actually make your life harder.

In the beginning, while you ideally want a bookkeeping system that’s scalable and will grow with you, it’s best to keep things as simple as possible.

At its most basic, you’ll need three types of records:

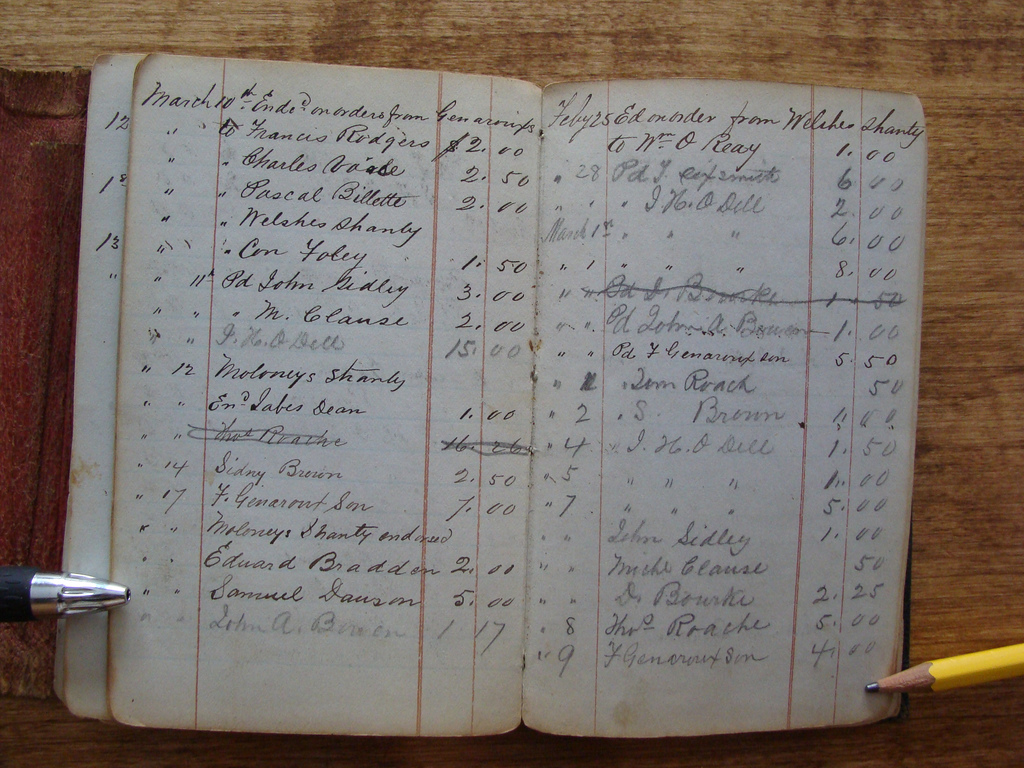

- A cash book – to record payments to and from your bank account. When this has a few months’ history, it will be useful for forecasting future expenses or profits, as well as reviewing historical balances.

- A Sales Invoice File – Keep all your invoices together in one file. They can be physical printouts or digital records as long as they’re where you can find them. Keep track of which remain unpaid to make credit control a little easier.

- A Purchase Invoice File – When you receive a purchase invoice, write on it when you paid and the payment method. HMRC will accept digital copies of invoices, so if you’re doing your accounting online, you can upload a copy and destroy the paper original.

Hire Professional Services

Given that bookkeeping

is such an important part of business, professional services can keep your finances in order and even reduce your tax bill.

Many businesses use both bookkeepers and accountants:

- Bookkeepers – take care of updating financial records and transactions on a daily or weekly basis. They will keep your accounts up to date and properly organised.

- Accountants – take the books prepared by a bookkeeper and use the information to prepare your tax return. Accountants also have the specialist knowledge to glean insights about the business by interpreting the figures, and can often give specific advice to startups. They will make sure you’re claiming all your expenses and allowances, and are being efficient with available resources.

- Platforms – innovations in cloud technology are developing online platforms for managing your accounting data that help with d0-it-yourself or professional service providers.

Short courses are available if you’re new to bookkeeping and want to handle record keeping yourself. Your local Chamber of Commerce may be able to help or point you in the right direction. It’s advisable to get some sort of basic training so you know what’s necessary and what you can safely leave out.

Understand Business Expenses

While the saying goes that you shouldn’t mix business with pleasure, sometimes it’s possible to do just that and still claim some business expenses. Knowing the rules is key to staying on the right side of HMRC

.

- If a trip is wholly for business purposes, you can claim all expenses.

- If some of the trip is for pleasure, you’ll need to carefully separate the two and only claim those relevant to business.

You can, for instance, claim hotel expenses while you’re attending a two-day business conference. You can’t, however, claim an additional hotel night if you decide to stay longer and go sightseeing.

The same applies to travel expenses. You can claim the return cost of train tickets, for instance, so you can travel to your client’s town for a meeting, but you can’t then add additional train costs if you choose to travel further for personal reasons.

When it comes to separating business and personal expenses, an accountant can keep you on the right track with your record keeping challenges.

Avoid Tax Bill Surprises

Tax bills can come as a shock, even when you know one is due. It saves a lot of scrambling if you set up a savings account that runs throughout the year, and put aside 25% of everything you make. By doing this, you’ll easily cover your tax, and if your liability is smaller than you thought, you’ll have money left over.

Share the Load

If you’re not ready to hire a bookkeeper or accountant and you have a business partner, share the job of keeping financial records straight. You both have a vested interest in understanding how financially healthy the business is, and sharing bookkeeping tasks will keep everyone up to speed.

Either take turns on a rota basis, or sit down together to do the record keeping work. Other advantages in sharing responsibility include not neglecting basic bookkeeping tasks when the responsible partner is on holiday or sick.