5 Big Reasons You Should Be Saving Your Pay Stubs

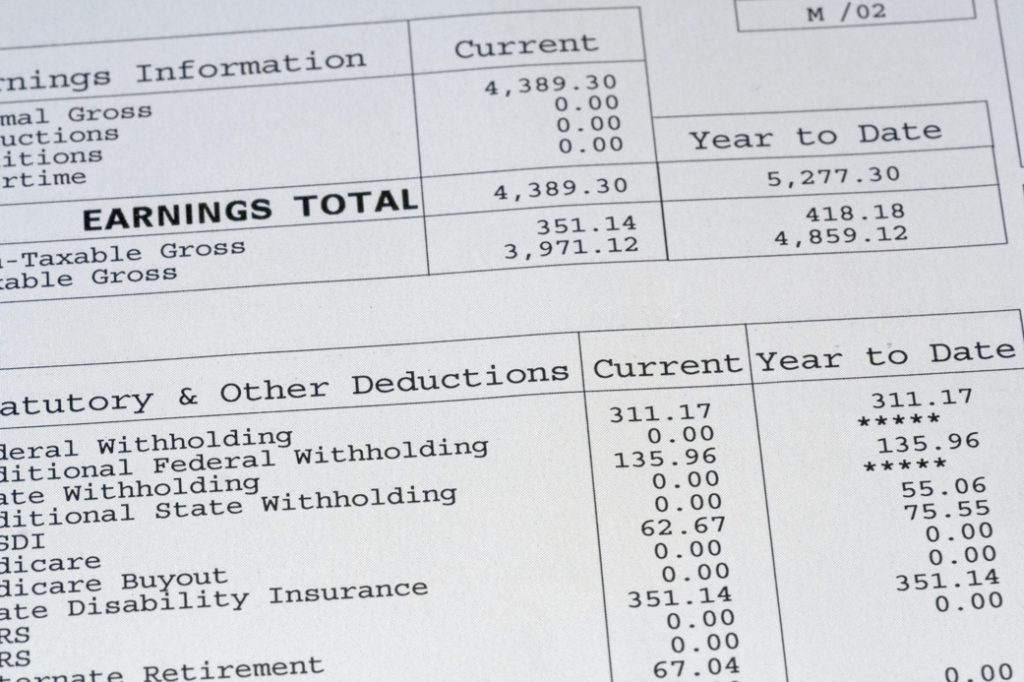

Gross wages, net pay, health insurance, social security, and other deductions are some of the information found in pay stubs

. Are you keeping a copy of these payroll documents? If you answered no, you should print a copy of your most recent financial documents as soon as you can. Believe it or not, you can use them for more than learning the amount of your direct deposit. Want to learn why these payroll documents are important?

Here are the top 5 reasons why you should start keeping your pay stubs today.

1. Filing Your Taxes

You may think a pay stub is only important to keep tabs on your paychecks. However, maintaining copies of these documents can help you file your taxes accurately. Even if you don’t file your tax return yourself, it will make it easier for your accountant to complete your taxes when you provide this information.

2. Identity Verification Purposes

When you open a bank account, your financial institution will request documents to verify your identity. Every pay stub shows your social security number, among other personal details. You can provide a copy of your most recent pay stub to verify your identity. Your bank may also request a copy of your social security card, state-issued identification, among other documents to confirm the information from your pay stub.

3. Keeping Track of the Hours You Work

If your employer pays you per hour, every pay stub will detail how many hours you worked in that pay period. When you keep copies of these documents, you’ll be able to keep track of all the hours you work.

4. Get Ready for Any Tax Audit

Maintaining accurate financial records is vital to protect yourself during a tax audit. It doesn’t matter if you are a freelancer or employed by a company. Federal or state taxing agencies can come knocking on your door to audit your records. When you keep a copy of every pay stub you receive, you’re preparing yourself in case you’re subject to a tax audit. You can submit these financial documents to support the information from your tax filings.

5. Proof of Income

Obtaining financing and applying to lease a property are examples of situations when lenders and other parties may request proof of income. Most companies will accept a copy of your most recent pay stub as evidence of your income. Freelancers can also use these financial payroll documents to prove their income. If you’re self-employed, you may consider websites such as www.paystubs.net

to create your pay stub. You should also consider consulting an accounting expert to make sure you include the right information when generating your pay stub.

If you aren’t keeping any records, you should start saving your pay stubs as soon as you can. You may not need them right now, but you’ll need to submit these financial documents to obtain financing or even lease your next home. You may think keeping these records isn’t important for freelancers or self-employed individuals. Yet, generating and maintaining copies of every pay stub can save you time and money when filing your taxes.

If you’re unsure about the best way to generate or maintain your financial records, you should consider consulting an accounting expert. An accountant can provide insight into how long you should keep these copies and the importance of these records for self-employed individuals.