The Fastest Growing FinTech Apps in 2019

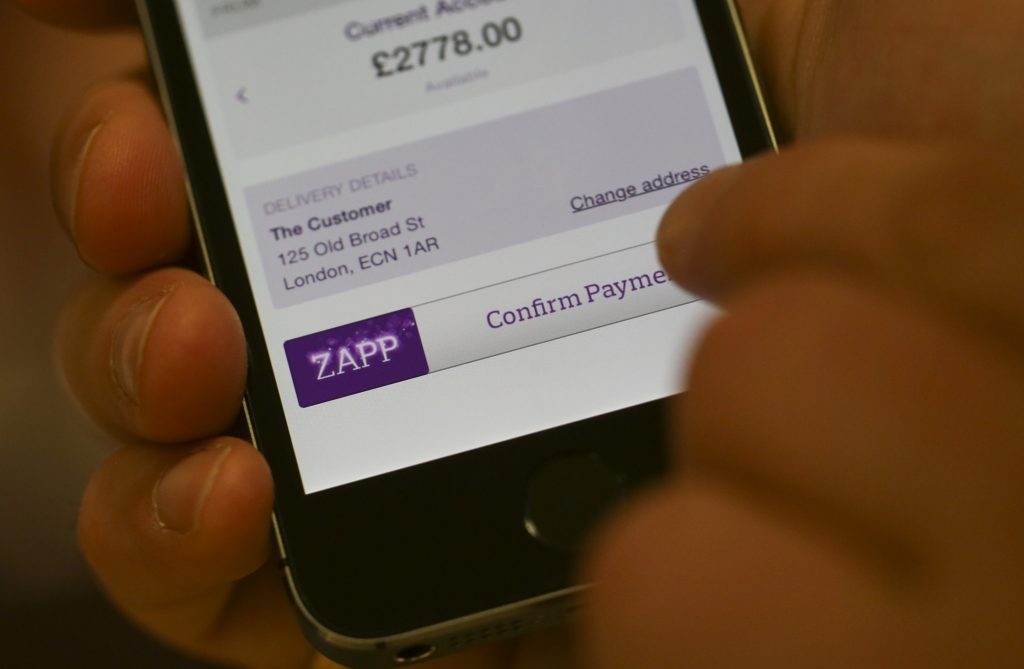

We all use financial technology apps. It started with PayPal and then moved on to banks that are entirely online, with no branches. We now Venmo rent to our landlords and use Apple Pay at the corner store. It’s hard not to use all these FinTech applications when we don’t want to carry too much cash around. Even credit cards aren’t as safe anymore as they get hacked, lost, or stolen. Financial apps, on the other hand, work either with your fingerprint or face ID, making it harder for someone who isn’t you to spend your money.

The FinTech industry is huge, and it continues to take the online market by storm. Even traditional banks are hopping on that wagon. Having a banking app has become pretty standard, and it now goes past just checking your balance.

You can use these apps to cover payments without revealing your plastic card or your personal information, and you can also use them to send and receive money. There are many fintech apps to look at in awe, but we’ve compiled a list of the ones that grew fastest this year.

BrainTree

BrainTree had a head start on a lot of other apps because it’s under the PayPal umbrella, so they have experience when it comes to financial technology. It provides a service for big companies and businesses.

It’s an excellent platform for payments that are too big for PayPal. Businesses all over the world have started using the app. It accepts payments through Venmo as well as PayPal, it’s secure, and it prevents fraud.

Forward Financing

Forward Financing is the way to go before you start a business. It’s an online lending platform that lends starting capital to start-ups. Founded in Boston, it’s only available in the United States.

Since its foundation, it’s already lent over $500 million to business owners. The whole process is online; there’s no branches to visit or lines to queue. Its technology runs the necessary checks based on the information customers enter, and the funds can be transferred in as little as a day.

It’s safe, they provide great rates depending on your credit history, and it’s easy. In this day and age, it’s quite relieving when you can handle your financial obligations without having to go anywhere or meet anyone.

Lending online has been heavily debated by Forbes Magazine

but has proven to grow fast and steady as fintech apps gain credibility.

ShinePay

ShinePay is here to make payments easier than ever. It can be used to solve a wide range of financial problems. They offer world-class engineering and ease of access wherever you are. It can even accept mobile payments on your laundry machine.

Coming out of Silicon Valley, the app promises safety and security, and easily usable world-class technology at the lowest prices. It includes an unparalleled amount of technology from Facebook, Apple, IBM, and many more.

For its age, it’s quite advanced, safe, and secure and a lot of big businesses and people have already started using it. It’s already gathered a lot of loyal customers in very little time, which speaks volumes about how good and efficient it is.

Suplari

Suplari goes past making and accepting payments. It offers us something we all need, and that’s money management. Suplari is based in Seattle, and it helps its users get on top of their finances.

The process is simple; you enter your information, your budget, how much you’d like to save each month, and it creates a program for you. The app uses artificial intelligence and machine learning to track spending trends and make suggestions based on that.

You can count on Suplari to help you gain control of your money and always have money saved.

Robinhood

Robinhood doesn’t take from the rich to give the poor, although that would be awesome. What it does is actually simpler (and more sustainable). It’s an application that helps investors track their investment as well as figure out where to put their money from their desktop or mobile phone.

It doesn’t have any physical branches, making the entire process possible from your phone, tablet, or desktop computers.

Get Your Finances on the Internet and Keep Them Safe and Easily Accessible

There’s no reason not to manage your money, take payments, and make payments on the Internet. Completing transactions online has become increasingly safe and easy. Furthermore, these fintech platforms are easily accessible from anywhere.

You can now handle your finances from the comfort of your own home or office, or even from a hammock on the beach in Costa Rica. It really doesn’t get easier, and anyone who refuses to go online with their transactions is basically missing out.

One real driving factor is that a lot of banks in the United States and Europe are moving their transactions online and making it impossible to not hop on this fast-moving train.