Managing Risks with Comprehensive Shop Insurance

Perhaps the most important part of running a business is being prepared for any eventuality. Whilst owning your own business can be an incredibly rich and positive experience, it’s just common sense to make sure that you are aware of all the risks.

What Are the Different Types of Risk?

There are many different types of risk which can affect businesses. Some of these are common to all businesses, whilst others are dependent upon a number of different factors. These may include:

- What type of business you own

- Where your business is located

- How many employees you have

For example, a business which is located in a quiet town may be less at risk of theft than one which is located in a large city. And a business owner who has a shop may find that their business is at risk from damage to contents, whereas an online business may not need to take this into account.

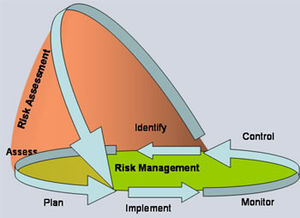

Conducting Risk Assessment

Risk assessment refers to the process of identifying risks to your business, and determining the best course of action to take to both minimise the chances of a risk occurring, and deal with risks as and when they arise.

Health and safety often plays a large role in risk assessment as it covers a wide variety of situations. These can include anything from repetitive strain injury to proper use of industrial machinery or slips, trips and falls. Risk assessment in this area might involve making sure that all staff are trained to use equipment properly, or that they are fully aware of how to properly deal with spillages.

In the case of a shop, risk assessment may also include identifying any risks to stock – including both damage and theft – or circumstances in which your business may be interrupted. For example, if your business experienced a loss of power which affected trading, you would need to make sure that you are prepared in advance for this loss of revenue. Unfortunately, it is often the case that predicting this type of situation is difficult, if not impossible.

How Shop Insurance Can Help

Since it is difficult to predict when some risks will develop, being able to protect your business after a risk situation occurs can be difficult. But there is one solution which can help you to prepare for any eventuality in advance – insurance.

There are many different types of insurance, and if you own a shop you can even find specific shop insurance which covers a wide range of areas in which unforeseen events may negatively affect your business. As it is shop specific, this type of insurance is the perfect choice for business owners who want to be covered against a wide range of risks which may affect their employees, their customers and their premises. Shop insurance can even be further tailored to meet your specific needs, so whether you own a corner shop, florist or salon, you’ll be able to rest assured that your business is protected from harm.

Related articles

- How to cope with stress in the workplace (thestartupmag.com)

- Women in Startup, The Girls Mean Business! (thestartupmag.com)

- How small businesses can find buyers in China (thestartupmag.com)