A Simple Guide to Invoice Financing for SMEs

Small and medium-sized enterprises (SMEs) play a vital role in driving economic growth but often face cash flow issues that can hinder their development. Late payments from clients can create liquidity problems for these businesses, affecting their ability to meet operational expenses, invest in growth, or pay suppliers on time. To overcome this financial challenge, SMEs can turn to invoice financing as a viable solution. In this guide, we will explore how invoice financing works and the benefits it offers for small businesses.

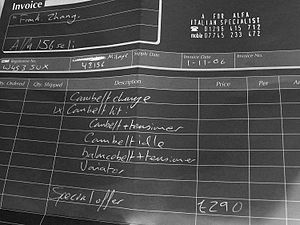

Understanding Invoice Financing

Invoice financing is a financial product designed to help businesses overcome cash flow problems caused by slow-paying customers. Here’s how invoice financing in Australia and other areas works: Rather than waiting for clients to settle outstanding invoices, SMEs can sell these invoices to a finance provider at a discounted rate. This allows businesses to access immediate funds that they would have otherwise waited several weeks or even months for.

Types of Invoice Financing

Factoring

Factoring is one type of invoice financing where SMEs sell their invoices outright to a factoring company in exchange for immediate cash. The factoring company assumes responsibility for collecting payment from the client and handles credit control duties as well.

Invoice Discounting

Unlike factoring, invoice discounting allows SMEs to retain control over collecting payments from their customers. With this arrangement, businesses borrow money against their unpaid invoices and repay the finance provider once the client settles the bill. Invoice discounting is typically confidential (also known as “disclosed”) or disclosed depending on whether the customer is aware of third-party involvement.

The Benefits of Invoice Financing

Improved Cash Flow

The most significant advantage of invoice financing is improved cash flow. By accessing funds instantly instead of waiting for customers’ payments, SMEs can cover business expenses promptly, pay employees on time, and efficiently manage daily operations.

Enhanced Working Capital

With a steady cash flow, SMEs can expand their business operations or invest in new opportunities to drive growth. Invoice financing provides the necessary working capital for businesses to seize these opportunities, be it hiring additional staff, purchasing inventory, or upgrading infrastructure.

Avoiding Accumulating Debt

Invoice financing is not a loan; rather, it allows businesses to convert unpaid invoices into immediate capital. As a result, SMEs can avoid accumulating debt and minimise the risk associated with traditional credit facilities.

Outsourcing Collections

One of the greatest benefits of invoice financing, particularly factoring, is the outsourcing of collections. When an SME sells its invoices to a factoring company, all responsibility for recovering payment from clients is transferred. This not only frees up time and resources but also reduces the administrative burden on small businesses.

Is Invoice Financing Right for Your Business?

Invoice financing may be suitable for your SME if:

- a) You have reliable customers but face delayed payments.

- b) Cash flow issues are hindering your growth potential.

- c) You lack collateral or have a limited credit history.

- d) Your business operates in seasonal cycles.

Moreover, invoice financing is available to diverse industries such as manufacturing, retail, construction, and more.

Choosing the Right Invoice Financing Provider

As with any financial decision for your business, it’s crucial to choose the right invoice financing provider. Consider the following factors:

Reputation and Experience

Look for an established finance provider with experience serving SMEs in your industry. Check reviews and testimonials from other businesses who have used their services.

Fees and Terms

Compare the fees offered by different providers and understand their terms. Ensure you are comfortable with their pricing structure and any potential hidden costs involved.

Customer Service

Excellent customer service should be a priority when selecting an invoice finance provider since you will be working closely with them throughout the process. Consider how responsive and helpful they are during the initial discussions.

Conclusion

Invoice financing offers a lifeline for SMEs struggling with cash flow issues caused by delayed payments. Whether through factoring or invoice discounting, businesses can access immediate funds and unlock the full potential of their outstanding invoices. Improved cash flow, enhanced working capital, and the benefits of outsourcing collections are just some of the invoice financing benefits and advantages offered to small businesses. By choosing the right provider and understanding the terms, SMEs can leverage this financial solution to support their growth aspirations.